CEWS, like other new government benefits programs have been created during the COVID-19 outbreak. The goal is clear. It is to provide qualified employers with financial assistance to hire back employees that were previously laid off due to the Pandemic and put those businesses in a better position to recover.

From an accountant’s perspective, we always ask the question: at what price? According to the Parliamentary Budget Officer’s recent publication, the total net cost of CEWS is estimated to be $59.2 billion, which is based on the expected subsidies for ten four-week periods from March 15, 2020 to 19 December, 2020. There is no doubt that the Government is determined to ensure the benefits are delivered to the businesses promptly. But if you understate the determination that the Government is to stop the abuses of the CEWS program and have no preparation for CEWS audit, then…you may be caught up with a big surprise.

Honestly, the eligibility requirements for the CEWS is complex for average business owners. If employers are not eligible for CEWS, they will be required to repay any amounts received. Is that simple? No. If the application was found out later that the related information was artificially manipulated in order to be qualified for CEWS, employers are required to repay any amounts received plus a penalty equal to 25% of the total value of the CEWS received. Hefty penalty will be imposed in deliberately abuse.

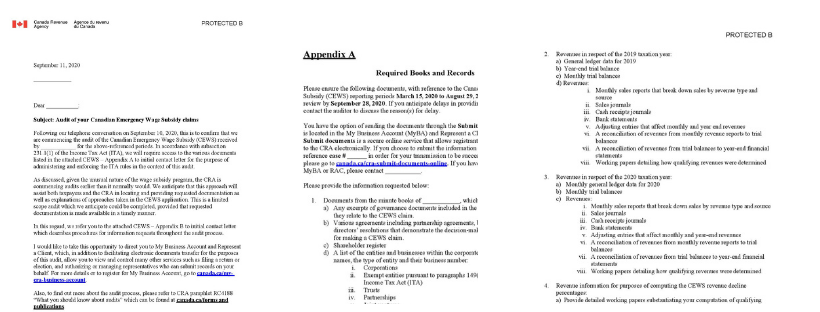

So, how to prepare for a CEWS audit then? Recently, a redacted CRA letter informing of an employer of a “limited scope audit” on its CEWS application was shared in LinkedIn. Sample pages are presented below:

This letter gives us some idea that the CEWS audit looks like and what the CRA is looking for. Here are some highlights:

- Level of details

The letter requests information from accounting records like 2019 and 2020 revenue details; General Ledger as well as adjusting entries; to detailed payroll data by pay period and by employee for all claim periods, including SIN#, hours or days worked in a week for any irregular pay periods; The requested details are overwhelming even for many tax professionals.

- Turn-around time

Surprisingly, 10 business days only are given for employers to prepare 3 page-long list of items. I believe 10 days would be a mission impossible for many business owners, given that the businesses have been scaled down and understaffed due to the COVID-19.

- Limited scope vs. large scale

It has bee said that this sample letter is for a limited scope audit. How does it look like for a large-scale audit? There is no answer yet. But you can imagine.

So, going back to the question on how to prepare for a CEWS audit. Here are some tips:

1.Stay calm and take actions on the documents required by the CRA and assess the gap of missing information;

2.Review the supporting documents in respect of your CEWS application and make sure they are consistent and well explained;

3.If there will be a delay in summitting the documents to auditors, professionally communicate with the CRA auditors and hopefully a new timeline can be rescheduled.

4.Take the audit seriously. As the CEWS program is administered through Payroll Account, accordingly, liability exposure to corporate directors arises when the audit issues are noted.

If you have been contacted by the CRA for a CEWS audit and worried about the tight deadlines, you can look for professional help with CEWS audits. We are here to help. Give us a call at 647-872-6656.

The information in this article is current as of the time it was written and considered as general guidance only. The article cannot be relied upon to cover specific situations and you are advised to consult with tax professionals for further guidance.

Recent Comments